Section 179 Business Tax Deductions

What Is Section 179 (and Why Does It Matter in 2025)?

Section 179 of the Internal Revenue Code empowers businesses to deduct the full purchase price of qualifying equipment and software in the same tax year they're put into service. Instead of stretching depreciation across several years, you can claim the entire cost upfront-dramatically improving your cash flow and creating immediate tax benefits.

Why Section 179 Matters for Your Business

- Immediate Tax Impact: Rather than waiting years for depreciation benefits, claim the full deduction in 2025

- Enhanced Cash Flow: Keep more working capital in your business when you need it most

- Strategic Growth: Upgrade equipment sooner and maintain competitive advantages in your market

Quick Reference: 2025 Section 179 Limits

Transform your business purchases into immediate tax savings with Section 179. This comprehensive guide explains how to maximize the 2025 deduction limits and preserve your company's cash flow.

- Max Deduction (2025): $2,500,000 (phased out above $4,000,000)

- Bonus Depreciation (2025): 100% (applies after Section 179)

- New & Used Equipment: Qualifies for full Section 179 deduction

- Specialized (Non‐Passenger) Vehicles: No special limit (treated like equipment)

- SUVs & Trucks >6,000 lbs GVWR: $31,300 max first‐year Section 179; remainder depreciated

- Business‐Use Requirement: >50% business use; deduction limited to % of business use

Note: The Section 179 deduction phases out dollar‑for‑dollar when total qualifying purchases exceed $4,000,000 and is fully phased out at $6,500,000.

H.R.1 (effective for tax years beginning after December 31, 2024) doubled the Section 179 limit to $2,500,000, raised the phase‑out threshold to $4,000,000, and reinstated 100% bonus depreciation.

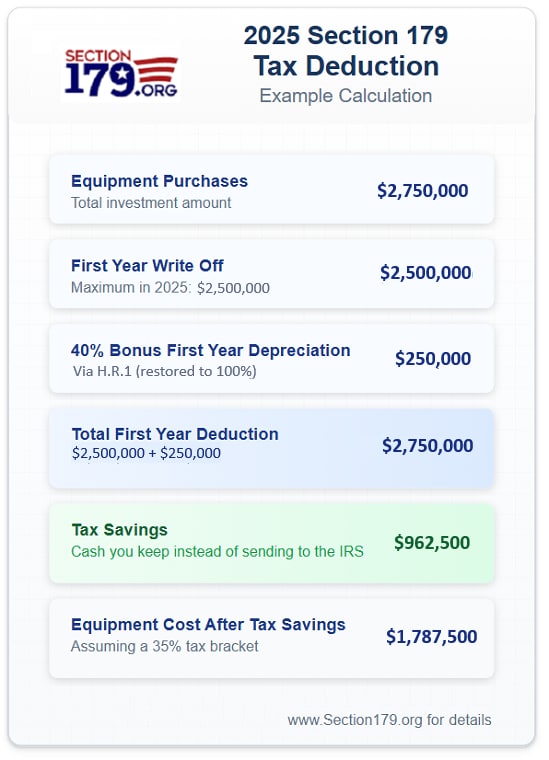

Example: How Does Section 179 Generate Tax Savings?

This example illustrates how Section 179 can dramatically reduce your after-tax equipment costs. For a $2,750,000 purchase:

- Section 179 Deduction: $2,500,000

- Bonus Depreciation: $250,000

- Total Tax Savings: $962,500 (at 35% tax bracket)

- Final Equipment Cost: $1,787,500

How to Plan Your Section 179 Strategy

What Are the Requirements for Qualifying Property?

- Must be primarily for business use (>50%)

- New or used equipment qualifies

- Must be placed in service by December 31, 2025

- Cannot be inherited or gifted property

What Is Section 179 Qualified Financing?

Take advantage of specialized Section 179 Qualified Financing to maximize your tax benefits while preserving working capital:

- Minimal down payments with flexible terms aligned to your cash flow

- Claim full Section 179 deduction even on financed equipment

- Tax savings often exceed your first-year payments

- Quick approvals to ensure December 31 deadline compliance

- Financing structures designed specifically for Section 179-eligible purchases

Contact Finley Motors to Learn More

How Can We Help?

* Indicates a required field

-

FINLEY MOTORS, INCORPORATED

700 Lincoln Ave South

Po Box 175

Finley, ND 58230

- Sales: (701) 409-0977